A New Generation Takes Over

Private Equity Insight/ Out #12

The world is evolving as is the private equity (PE) sector. What are the aspirations of the new generation of leaders? Emmanuelle Castella (New Angle Capital), Aurélie Comptour (AI Global Investments), Katrin Katzenberger (Royalton Partners), Maxime Miossec (PAI Partners) and Nicolas Milerieux (Encevo), young leaders working in the private equity sector, agreed to share their views with us.

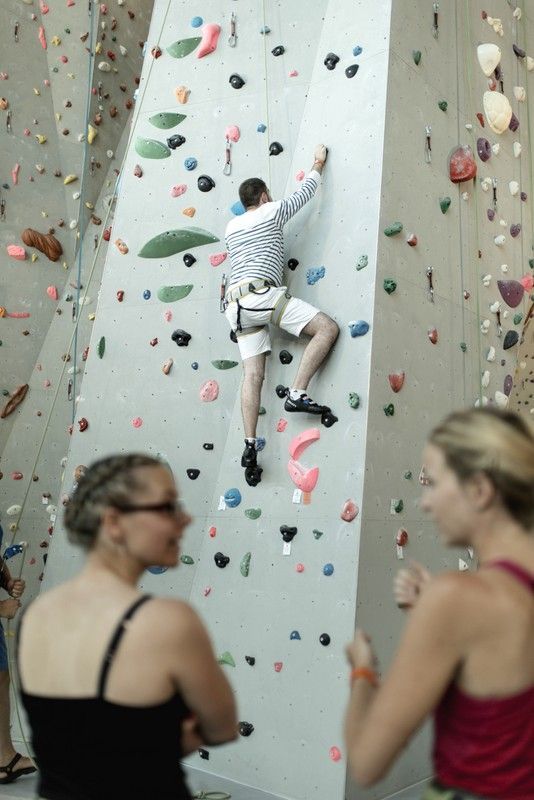

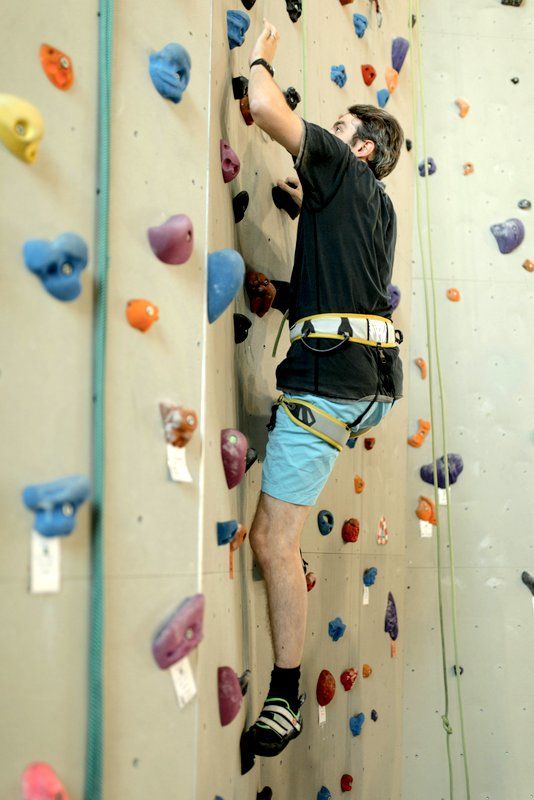

We met the young leaders at the Centre National Sportif et Culturel d’Coque in Luxembourg where, in exchange for their thoughts, we incentivised them to reach new heights by way of a monitored wall climbing session, a first time for all.

Read the interview below and be inspired by the next generation of PE leaders:

“Having a happy private life leads to the fact that I am doing a better job at work.”

Katrin Katzenberger

General Counsel, Royalton Partners S.A.

What motivates you most in your job and what / who are your sources of inspiration?

Aurélie Comptour (AC): I would say it is the non-recurring types of business, diversity of investments/ industry/ geography and a mind-set focussed on entrepreneurship.

Emmanuelle Castella (EC): In private equity your job is to invest in companies and as such you are investing in the future of people and impacting their lives and of those around them which gives a certain meaning to your job.

Nicolas Milerioux (NM): Striving for innovation is full of surprises and challenges, and each day is a new off-road, bumpy adventure. But I always keep in mind the long term vision and take both successes and setbacks in my stride. Never give up and keep on climbing focusing on the peak.

Katrin Katzenberger (KK): My motivation is the team around me. I am convinced that without a good team, no one can do a good job.

Talking about new emerging trends like ESG – Environmental, Social and Governance, in the context of PE, what do this term mean to you?

EC: We are conscious of the impact that private equity can have on society and on the environment as a whole. It is therefore our responsibility, as an investor in the future, to make sure that the companies we invest in meet the ESG standards that we would expect of any company we would want to be associated with. Of all the ESG standards, we (NAC Partners)have the Environment impact closest to our hearts and always see how the company addresses environmental issues before committing to an investment.

Maxime Miossec (MM): The ecology and the environment is something that is very visible, very public and very sensitive. I take the example of my company (PAI Partners) where we have a dedicated ESG team. Our commitment to responsible investment is central to our activities, and fully integrated into our policies, processes and outcomes. ESG is now one of the key challenges in doing business.and Our targets have understood that and most of them have set-up dedicated teams themselves.

NM: Energy generation is directly linked to environmental concerns. We are clearly in the middle of a transition in generation and use and need to start acting now before the burden from overusing our resources increases for next generations.

“Striving for innovation is full of surprises and challenges, and each day is a new off-road, bumpy adventure.”

Nicolas Milerioux

Investment Manager, Encevo S.A.

Is there a difference in a way you, as a new generation of leaders, tackle everyday challenges?

Katrin Katzenberger (KK): Compared to the older generation the younger generation is coming with laptops to meetings and in addition to the laptop they are using their smartphones, sending messages during the meetings. In a negative way, we/the younger generation is less focused but to summarize it in a positive way, we can be more efficient with all the media, being multitasking.

MM: New technologies, social media and digitalisation allows new generation to remain connected to the whole world at all time and to be ready to face new challenges in business with a strong reactivity.

NM: I believe that, with enhanced access to information, we’ve learned early on to work on quicksand. We may be more sensitive to new concepts, technologies and approaches and accept failures as a learning curve towards something better.

EC: Ways of communication and web content has resulted in a paradigm shift in the way people now work and conduct business which has particularly been embraced by the new generation. Quick access to knowledge and business contacts (such as LinkedIn) has resulted in younger generations being able to access information that was previously reserved to senior people.

Is work-life balance, a myth? People say that your generations is much more sensitive in regards of work – life balance? If this holds true for you, can you tell us your secret?

MM: I think it’s true that work-life-balance is more important for my generation than for the older one. I also had the opportunity to see that in my previous life as an auditor. I have a job which is very exciting and requests a hard commitment. As I got a child earlier this year, it is obviously something with which I need to manage and find the right way to conciliate both

AC: Not true in my case especially when you love your job!

EC: As I do a job that I really love, it has been easy for me to find a certain balance. Daily life for me is synonymous to diversity through the inspiring people I meet, the multiple tasks I conduct simultaneously, and the businesses and technology that I discover.

NM: When I arrive on holidays I try to put my phone aside and I just look at it in the evening. Only a few people can reach me during these times and for critical emergencies only. But when you’re passionate about what you do, it’s always difficult to fully disconnect.

KK: I know that having a happy private life leads to the fact that I am doing a better job at work. I am much more committed to what I am doing, also to my partners, as I know that they respect my private life.

“It is our responsibility, as an investor in the future, to make sure that the companies we invest in meet the ESG standards”

Emmanuelle Castella

Senior Associate, NAC Partners S.àr.l.

Do you see any generational shift in PE’s portfolio companies?

AC: The new generation of management at the level of the portfolio companies is now more open to receive financing from institutionals which are not banks. Nevertheless, Europe is late compared to the US – a lot remains to be done!

KK: I definitely see a shift in generation. The core team I am working with, have been together for more than 30 years. Recently we on-boarded a fund where the whole board was in the 40s and we decided for a younger colleague to join this board. Although the older ones have the experience and knowledge, the younger generation brings the spirit and can definitely positively influence the way going forward, this is what counts today and turn to be a perfect fit for the board mandate in question.

EC: I think that the younger generation believes more in the importance of providing value-add pro-active to portfolio companies while the older generation GPs were more strictly financial oriented. As part of this shift, we work hand-in-hand with company managers and focus on value creation (expansion to international, new business model…).

NM: Start-ups have boomed since the early 2000s and we see an increasing amount of young entrepreneurs raising bright ideas and scaling up faster thanks to globalisation. We have opportunity to do great things but now we have to prove that we are up to the challenge.

Is the younger generation of PE fund managers best suited to deal with the new challenges of the sector such as digitalisation or blockchain technology?

NM: I think it is not a question of age but it is a question of what we’ve been exposed to in the past. Being our age today, we are more likely to have grown up with some of today’s technologies or their predecessors, so our interaction with them – is almost instinctive. Blockchain I think is not (yet) well known by our generation. The kids in high-school will know much more than we do in 5-10 years. I remember that when I was a kid, computers were not yet a mass market…

AC: PE mind-set is not a question of generation. Never mind your age, a PE mind-set means to be reactive, adaptable and open minded.

EC: I don’t think it’s a question of generation. A fund manager has to stay up-to date with the latest technologies and business ways. It is more a question of experience – if a person is used to invest in technology he knows which challenges he has to tackle. We do not invest in technology itself but in the managers that are used to be experienced with technology.

“The ecology and the environment is something that is very visible, very public and very sensitive.”

Maxime Miossec

Director, PAI Partners

What is preventing the sector to welcome more women taking leadership and management roles?

AC: I do not see any specificities to PE – welcome more women is a global trend.

KK: It is not a question of preventing. I think that changes from company culture to company culture. There are companies where it works very well and where women are even in majority. But the whole team has to welcome it, there are also teams where it is not accepted. Objectively, in Luxembourg you have an environment where it is very well possible to work as a woman because you can have a family, you have all that it takes to have your kids in child care if you want so. Iit also changes a lot in relation to the national background. There are the German firms with their German approach and others…

MM: … Yes I agree, there a difference between, for example, the German and French culture. But it is always a challenge to get the right person to the right position within a firm, independently being a man or a woman. Our industry is very demanding in term of commitment and it is not easy to find people that are ready to work hard and accept the challenge to find the right work-life balance.

KK: But it is also the proportion of the mix. It is not possible to have a company where the whole staff is working part-time. You can support it up to a certain level. Trust and confidence is part of it, you need to have back-ups. But it is not only the work-life-balance and to have children. It’s also about the family and taking care of for example your parents. If it is generally accepted in the company and if there is trust from the management that you do your work independent of the working hours, that’s more what counts.

Several studies say millennials are more prone to jump from “job to job”. In a sector characterised by the long term approach how will this affect PE?

AC: PE means non-recurring business and growing knowledge over the years. You constantly need to re-invent your approach to be open to new challenges and opportunities. This industry is moving and is capable to answer rapidly to the new market trends.

KK: Our generation is very much open to job offers. I experience to work in a firm where the partners work together since 27 years, if you see this and you receive a very nice package- you rather stay where you are.

NM: In theory, a PE team should work the entire lifespan of a fund. However, with a world full of global opportunities and industry size increasing, some may get offered top-notch opportunities. This creates gaps to fill quickly. As a result, the awareness for talent attraction and retention is rising in the PE industry. Employees feeling appropriately rewarded and happy at work stay on board. That’s how “veteran” teams in the industry have been assembled.

MM: Even if this is true, managing the staff turnover within a company is not a new subject. People working in PE are adaptable and ready to face changes and new challenges. Moreover, it is always good to welcome fresh minds and new point of views on a regular basis.

“PE mind-set is not a question of generation.”

Aurelie Comptour

Director of Corporate Management, AI Global Investments & CY S.C.A.

What does Luxembourg need to do to shift from a back-office to a front-office jurisdiction?

AC: Improve the connection / flights diversity and establish more trendy places.

MM: We have been growing our team in the past months, even if it’s difficult to attract the best talents in Luxembourg given that the local market is already saturated. Luxembourg authorities should do a huge promotion of all its advantages for GPs and PE companies to be 100% located in Luxembourg, and demonstrate to their people how life is enjoyable in our country.

KK: Time changes, we became an AIFM and for substance reasons our whole management moved to Luxembourg. Regulatory and tax substance is one reason why Luxembourg as headquarter location should be considered. I think the label “Luxembourg” is on a good way.

EC: It is all about the ecosystem: access to talented managers/ technology (engineers)/ funds (money).

It can be an initiative from the fund to ask their portfolio companies to come and move to Luxembourg. Maybe Luxembourg’s governance should instore fiscal incentives to invest in the economy and/or into Luxembourg based PE funds.

NM: Fund managers taking relocation decisions are usually coming with family ties that need to be appropriately addressed. I believe that Luxembourg still suffers from a lack of reputation but the gap is closing progressively. A dedicated relocation desk, tailored to these high end profiles, may be an option.

As we finish the interview, name the three incentives that drive the PE generation under 40 today.

NM: Challenges / Tangible impact / Fast-track.

EC: Impact on the future / Diversity of tasks and people you meet / Learning curve

KK: Make an impact in other people’s lives.

MM: Find the work-life balance which allows to be effective and make an impact at work while enjoying family life.

AC: Working for our future by investing in new projects / new technologies; Variable income and no geographic barrier – worldwide impact of the PE industry.