Luxembourg, 12th June 2025

The Luxembourg Private Equity (PE) and Venture Capital (VC) industry gathered to review the achievements of 2024 and congratulate the ten newly elected Board members.

The Luxembourg Private Equity & Venture Capital Association (LPEA) presented its Annual Report for 2024 at the Association’s Annual General Meeting (AGM), held on Wednesday, 11 June 2025, at the premises of BNP Paribas Securities Services.

Key takeaways from the AGM include:

- Membership growth: LPEA recorded a 16% increase in membership in 2024, welcoming 73 new members and reaching a total of 597 members – a growth that reflects the broader momentum of the PE and VC markets.

- International outreach: Continuing its mission to promote Luxembourg’s PE & VC hub abroad, LPEA organised 14 international seminars across Europe, the US, and Asia—including inaugural visits to Stockholm, Vienna, and Tokyo.

- Public affairs focus: To expand its advocacy reach, LPEA launched the Consolidated Public Affairs Group (CPAG). This initiative aims to strengthen LPEA’s voice in public and regulatory affairs, ensuring effective representation of the PE and VC ecosystem at both national and European levels. Composed of seasoned professionals, the CPAG serves as a central platform to monitor, assess, and respond proactively to key legislative and regulatory developments, while fostering collaboration with financial associations, public institutions, and private stakeholders.

- VC Masterclass: 2024 saw the launch of the first VC Masterclass Program – an immersive initiative led by experienced VC practitioners, offering hands-on insights into venture capital and innovation.

- AI Lab initiative: Another milestone in 2024 was the launch of the AI Lab, a dedicated platform for dialogue and collaboration on the use of generative AI in private markets. The Lab also addresses regulatory, ethical, and technical aspects, helping the industry remain innovative and future-ready.

- Team expansion: In line with this growth, the LPEA team welcomed three new members: Emilie Moray (Legal & Regulatory Coordinator) in September 2024, followed by Natalia Vieira (Events & Communications Officer) and Francesco Simonetta (Junior Marketing Officer) in early 2025. The total staff now stands at eight.

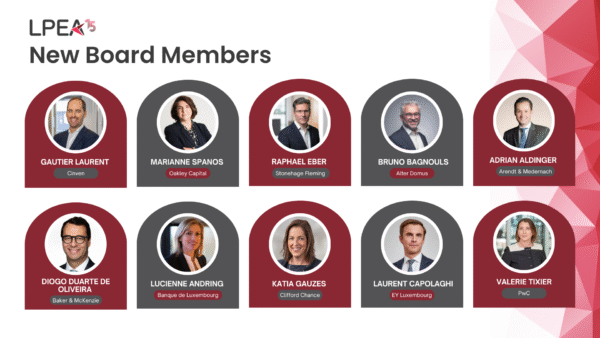

- Ten members were elected to the LPEA Board as part of the annual renewal of 1/3rd of this 30-member governing body. Among these ten, the following three Full Members (investors and fund managers) were (re)elected:

Cinven, represented by Gautier Laurent

Oakley Capital, represented by Marianne Spanos

Stonehage Fleming, representedby Raphael Eber

In addition, seven Associate Members (advisers/service providers) were elected:

Alter Domus, represented by Bruno Bagnouls

Arendt & Medernach, represented by Adrian Aldinger

Baker & McKenzie, represented by Diogo Duarte de Oliveira

Banque de Luxembourg, represented by Lucienne Andring

Clifford Chance, represented by Katia Gauzes

EY Luxembourg, represented by Laurent Capolaghi

PwC, represented by Valerie Tixier

After congratulating the newly elected Board members, Claus Mansfeldt, Chairman of SwanCap Investment Management S.A. and President of the LPEA, stated: “In 2024, private equity markets across Western Europe and North America experienced gradual stabilization, despite persistent macroeconomic and geopolitical headwinds. Deal activity proved resilient, with global deal count rising by 8% and deal value increasing by 20% year-on-year. As we move through 2025, cautious optimism is emerging, especially in Europe, encouraged by prospects of monetary easing, moderating inflation, and stronger deal fundamentals. Amid continued market fluctuations however, Luxembourg continues to thrive as a premier hub for private capital—attracting top-tier GPs and LPs drawn to its dynamic, diversified ecosystem and strategic position at the heart of global investment flows.”

Stéphane Pesch, CEO of the LPEA, stressed the need for continued efforts to further build up the PE & VC sector, stating: “As we enter a new chapter shaped by strengthened governance, member engagement, new business models and bolder ambitions, our mission is clear: to elevate Luxembourg as a complete premier hub for Private Equity and Venture Capital. Luxembourg’s future is bright—together, let’s embrace transformation and drive the next wave of growth.”

To close the AGM, the LPEA welcomed two keynote speakers:

- Following the blackout that crippled the Iberian Peninsula, Nicolas Milerioux, Head of Venture Capital at Encevo and David González García, Lead Engineer, Energy at European Investment Bank explored how innovation and investment are bridging critical gaps and reinforcing resilience in the European energy market amid mounting challenges and the urgent drive for sustainability.

- James Burron, Founding Partner of the Canadian Association of Alternative Strategies & Assets (CAASA), shared a timely update on Canada’s alternatives market, highlighting key trends, investor appetite, and the evolving role of private markets in portfolio construction.

About the LPEA

The LPEA is the representative body of Private Equity and Venture Capital professionals in Luxembourg. With 630 members, as of 12 June 2025, LPEA plays a leading role in the discussions and development of the ecosystem and actively promotes the industry beyond the country’s borders.

LPEA BOARD

| MEMBER FIRM | REPRESENTATIVE PERSON |

| A&O Shearman | Peter Myners |

| Alter Domus | Bruno Bagnouls |

| Arendt & Medernach | Adrian Aldinger |

| Baker & McKenzie | Diogo Duarte de Oliveira |

| Banque de Luxembourg | Lucienne Andring |

| BC Partners | Giuliano Bidoli |

| Blackstone | Tudor Sambritchi |

| Cinven | Gautier Laurent |

| Clifford Chance | Katia Gauzes |

| CVC Capital Partners | Caroline Goergen |

| Deloitte | Nick Tabone |

| EIF | Marcel Müller Marbach |

| Elvinger Hoss Prussen | Jeffrey Kolbet |

| EQT | Sara Huda |

| Expon Capital | Alain Rodermann |

| EY Luxembourg | Laurent Capolaghi |

| Fabien Morelli | Apollo Global Management |

| ICG | Hind El Gaidi |

| KPMG | Mickael Tabart |

| Luxempart | Lionel de Hemptinne |

| Mangrove Capital Partners | Hans-Jürgen Schmitz |

| Marc-Olivier Kiren | Astorg Asset Management |

| Martine Kerschenmeyer | Advent International |

| MiddleGame Ventures | Pascal Bouvier |

| Oakley Capital | Marianne Spanos |

| PwC | Valerie Tixier |

| Stonehage Fleming | Raphael Eber |

| The Carlyle Group | Estelle Beyl Vodouhe |

| Warburg Pincus | Raquel Guevara Merino |

| Wendel | Claude de Raismes |

For additional information please contact the office: lpea-office@lpea.lu / +352 28 68 19.