Blockchain: unlocking the value of distributed ledger technology in Private Equity

Capital V #10

Valeria Merkel, Associate Partner, Audit at KPMG Luxembourg

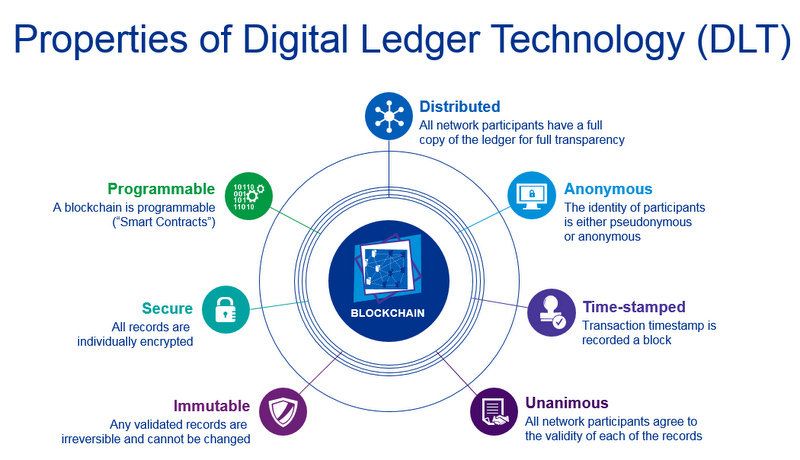

Not long ago, distributed ledger technology (DLT) was dismissible sci-fi hype, a faraway idea interesting but not yet relevant. However, times have rapidly changed: DLT, commonly called blockchain, is revolutionising the traditional and alternative asset management sectors while producing real use cases in banking, real estate, hedge funds, and private equity (PE). Prominent examples in PE include Northern Trust Corp’s use of blockchain for record-keeping, or Citi-Nasdaq’s partnership enabling payment services. PE players face many challenges remediable, perhaps, by DLT.

Challenges in PE

Intense competition, tight profit margins, and investors’ cost sensitivity have created rising cost pressures and necessitated new standards of efficiency and scalability. Simultaneously, the increasing volume of investment strategies, regulatory hurdles, and reporting requirements bring additional complication.

In operational terms, PE is ripe for evolution. Standardisation has not yet taken place, data is managed across disconnected platforms, and technological solutions seem to be lacking compared to other financial sectors.

Now would be the time for PE firms to invest in better technology. Both decision-makers and administrators stand to gain from DLT.

Benefits of DLT

- real-time transaction settlement and automation: smart contracts can automate the validation of, for example, transactions or automatic payments;

- transparency and disintermediation of distributed data: this results in there being one single source of truth, significantly decreasing the amount of reconciliation work; and

- notary function: blockchain can guarantee the authentication of documents and the traceability of records.

Potential uses

- investment analysis, sourcing, and decision-making;

- administration of investments; and

- ash-flow management.

For example, creating digital identifiers for portfolio companies would enable them to gather and share information, which would streamline investment analysis, decisionmaking, and due diligence processes. Administrative processes like transactions, capital calls, distributions, charges, and financing could also happen via DLT. Cashflows and contracts could additionally be done using smart contracts, as could the handling of investor rights, shares, and units, meaning transparency and real-time information accessibility and reconciliation.

Industry players must be on the lookout for new tools and start thinking about how DLT technologies may create value within their value chains. One future offering is FundsDLT, a DLTpowered platform for asset managers currently in the testing phase. Under development in Luxembourg by KPMG, InTech and Fundsquare, FundsDLT will interlink fund distribution supply chain players, from custodians to transfer agents to asset service providers, harmonising a currently fragmented ecosystem.

As an auditor who often leads operational discussions with clients, I am looking forward to revolutionary tools like this one.

Key Concepts