By Joaquín Alexandre Ruiz Tarré, Head of Secondaries at the European Investment Fund as featured in Insight Out Magazine #25

Now that we are still in the first quarter of the year, it is a good time to look backwards and see how the Secondaries Market has performed since 2021. Also, let’s try to gauge what we may reasonably expect for 2023.

Setting the scene…

2021 saw a speedy return to global economic growth, following 2020’s COVID-19 downturn. This was largely due to the progressive reopening of major economies, in parallel to a widespread deployment of vaccines and arguably broad immunization through omicron. However, high energy prices and supply chain pressures spurred a very high inflation. In public equities, we saw a rally in 2021, partially powered by massive pandemic support packages all over the world.

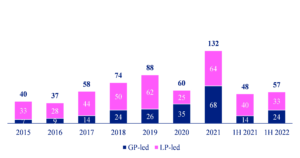

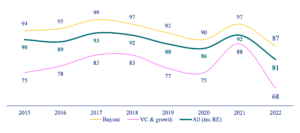

In the Secondaries Market, 2021 was a record year with volumes of c. USD 132bn, which is more than twice the amount reached in 2020 (c. USD 60bn), according to leading investment banks and/or advisors in secondaries[1]. Secondaries pricing also soared in 2021 with an average of c. 91-92% of NAV[2] (All Strategies)[3] for LP portfolios, slightly below the all-time high seen in 2017 (c. 93%).

Secondary market volume Bn USD (Source: EIF based on data from Evercore, PJT Partners, Campbell Lutyens and Jefferies)

In 2022, momentum turned and public markets went down significantly. For instance, S&P 500 (-19%)[4], Nasdaq (-33.1%)4, Stoxx 600 (-12.8%)4 and volatility became mainstream throughout the year. The war in Ukraine marked another black swan event in just 24 months. Beyond the humanitarian tragedy, and unprecedented sanctions to Russia, energy supply has been significantly impacted, thus adding higher energy prices to the already high levels of inflation. As a result:

- Central Banks have had no choice but to continue raising interest rates (raised even more in 2023: Fed 4.75%[5], ECB 2.5%[6] and BoE 4%[7]) to strive to get inflation under control;

- Major economies are expected to enter recession, according to Evercore4: USA (23e GDP Growth of 0.3% vs 1.9% in the preceding year), Eurozone (23e GDP Growth of -0.1% vs 3.2% in 2022) and the UK (23e GDP Growth of -1.0% vs 4.4% in the prior year).

Secondaries pricing also declined significantly in 2022, from c. 92% of NAV to c. 81% (All Strategies), albeit with significant dispersion between buyout (c. 87%) and venture (c. 68%)1.

LP portfolio pricing as % of NAV (Source: EIF based on data from Evercore, PJT Partners, Campbell Lutyens and Jefferies)

How has all this impacted the Private Equity industry and the Secondaries Market, in particular? Let us first have a look at three main metrics: deal value and volume, valuations and exits

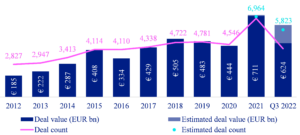

Despite a tighter policy environment, latest geopolitical events and continued volatility, European private equity deal making continued to be resilient; according to PitchBook. Yet, valuations measured by EV/EBITDA multiples went down. Not as much as some Secondary Buyers would have expected based on the performance of public markets. There has been an apparent disconnect between public and private equity valuations.

PE deal activity until Q3 2022 (Source: EIF based on data from PitchBook)

Median buyout multiples (Source: EIF based on data from PitchBook)

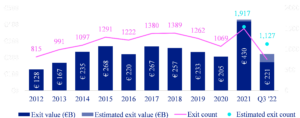

European private equity exit volumes reached EUR 221bn through Q3 2022, declining from the elevated figures reached in 2021. Exit values via public listings reached EUR 11bn through Q3 2022 (on pace to record the lowest annual total since 2012).

European PE exit activity (Source: EIF based on data from PitchBook)

Regarding secondaries…

2022 marked its second largest year ever with an estimated c. USD 105bn of volume transacted (average of several sources) vs. the all-time record of 2021 (c. USD 132bn transacted)1. Transactions were largely concentrated in the first and the last quarter. In Q1 22, many transactions that had been underwritten in Q4 21 closed, before the market entered into a perceived wait-and-see mode (following the invasion of Russia in Ukraine). By Q4 22, the market revamped, mainly fueled by LP-led activity benefiting from the impact of the so-called denominator effect[8] and a loosening of seller’s expectations in terms of pricing which materially impacted deal volume. In parallel, a lot of GPs returned to the market at the same time with their primary fundraisings, forcing LPs to decide how to (re)allocate their commitments.

In terms of transactions type, LP-led volumes went back to pre-COVID times, surpassing GP-led volumes (estimated to be c. USD 55bn, i.e., 54% of total transacted volume). Finally, the difficult fundraising environment overall also impacted secondaries, with most of the players still in the market at the time of writing this article. This inevitably slowed down deployment pace in 2022 (arguably building dry powder for 2023).

What to expect in 2023…

We predict continued opportunities on the LP-led side as some investors in the asset class may still be in need to offload some of their positions in 2023. They could not do so in 2022, possibly due to unmet pricing expectations.

Abundant supply of GP-leds expected, in particular on single asset deals, fueled by delayed natural exits at the underlying funds level. The latter results in slower distributions, and likely negative cash flow for LPs, as capital calls outpace distributions. Multi-asset GP-leds will probably be also in high-demand, as secondaries funds are deemed to seek diversification.

Volumes are estimated to surpass 2022, reaching USD 140-150bn if no other major macroeconomic or geopolitical event impacts the market in 2023. One of the factors possibly contributing to it, if private market valuations decline, is a reduced pricing gap (bid-ask); which is still perceived as significant.

As the old saying goes: “a river whose waters are rough rewards the fisherman” … Setting aside all the uncertainty, a favorable upcoming market momentum lies ahead for secondaries. As previous crises have shown, secondaries are usually well placed to perform strongly in or during post-crisis environments.

Copyright: D.R.

[1] Evercore, Jefferies, PJT ParkHill, Campbell Lutyens and Setter Capital.

[2] Net Asset Value.

[3] Buyout, Growth, Venture and Real Estate.

[4] From 1st of January 2022 to 31st of December 2022. Evercore: 2022 Capital Markets Overview – Equity and Debt Capital Markets.

[5] Fed Funds rate as of February 1st, 2023, lower bound: 4.5%, upper bound 4.75%.

[6] European Central Bank deposit facility as of February 8th, 2023.

[7] Bank of England base rate as of February 2nd, 2023.

[8] That is, the over-allocation to private assets due to a drop in public equities and bonds.