by Katalin Gallyas, Managing Director of c*funds BV – Fund Placement Agency

c*funds team has assessed approx 350 GP pitches during the last 3 years. Hereby we made a summary about the most often occurring GP mistakes while fundraising.

- “Overtalkative” GPs

It’s important not to dominate the GP-LP conversation, give room for questions from the LP, listen, and tailor your response while providing context. Remember to ask questions! Leave space for authentic personal touchpoints.

- Too optimistic on returns

Too often we see GP’s with only one realized exit forecasting very unrealistic portfolio returns (3.0x MOIC). If your projections are too high, expect to be questioned on how exactly you will deliver such stellar returns. It is better to under promise and over deliver.

- GP Partners are not committed to the fund full-time

Often we encounter GPs that are still having too many other side, executive, non-executive functions next to the fund. This is confusing and does not give the LP reassurance that the fund will be focused and supported enough to deliver on its thesis. In this case, less is more.

- GP stake too low

Having a GP stake of less than 2% indicates to LP’s that they do not have enough ‘skin in the game’. This alignment of interest is extremely important for LP’s.

- No data room

Lack of sophistication during your Due Diligence process is a red flag for many LP’s. Ensure your data room is encrypted and tracks user activity. This will allow you to track LP activity as they progress through the commitment process.

- Team lacks execution capabilities

Often we see top heavy GP teams (GP partners), without the analytical and deal sourcing capabilities that strong analysts/associates can bring. It’s important to show the LP’s that you have a strong team in place that can accommodate all the admin processes around sourcing.

- Team lacks diversity

It is important to demonstrate diversity at all levels (age, gender, nationalities) of team composition. Having diversity in gender and race is something that LP’s now expect from their GPs. Don’t be the outdated dinosaur in the room!

- Underdeveloped USP’s

We commonly see GP’s with USP’s including ‘proprietary deal flow’, ‘hands-on team’, ‘operational experience’. These are not USP’s! They are requirements for successfully running a fund. Take the time to really carve out why you are different from the rest.

- Team size does not match geographical scope

Make sure that your team size and depth reflects the markets you plan to operate in, it will be a hard sell to a LP that your team of 3 can ‘cover the whole of Europe’.

- Burning valuable LP leads too early in the process

You only get one shot when introducing yourself to a LP. Make sure you are completely prepared with all required documents before you put yourself in front of capital. You don’t get second chances.

- Inconsistency with fund branding

Make sure your website, pitch deck, teaser and any other fund documents have a consistent presentation and brand. You need to make an impact and looking good is part of this.

- Under the radar approach

Make sure you are ‘on’ the radar, not ‘under’ it! It’s important to bring out your inner hustler during the fundraising process, be present at fundraising events, network, build your brand. Do not be invisible.

- Premarketing underdeveloped

Make sure your pitch deck has no excess pages, speaks succinctly to your investment thesis and is easily digestible and understood. You can only imagine how many pitch decks LP’s review on a weekly basis, you have one chance to stand out from the crowd so make the most of it.

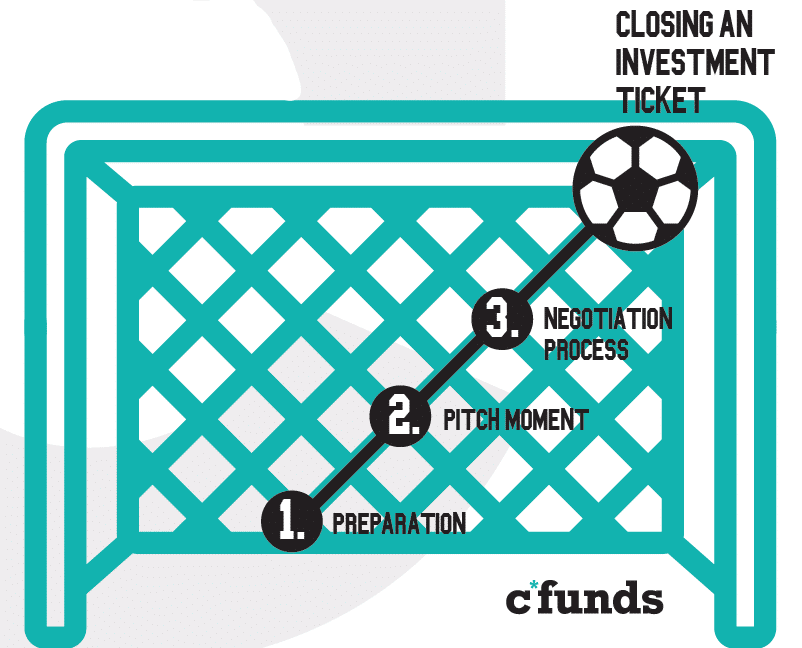

Most often made mistakes by GPs per fundraising stage

- Preparation

- strategy mistake: too small fund for too big geographical coverage Insufficient portfolio management skills onboard

- no data-room: no sanity around results/ set-up/tracking

- too optimistic with returns (3x multiples for 1st time VCs)

- team not full-time engaged (too many side /non-executive functions/distractions

- team set-up: lacks executions (analysts)

- team is not diverse enough (gender, nationalities, age)

- USP’s are too common sense /not memorable

- fund brand inconsistency

- Pitch moment

- ”over talkative” GP

- not answering the Q’s

- missing the a personal context/authenticity

- burning valuable leads too early

- not visible in the market/”under the radar approach” /no events

- Negotiation Process

- reducing management fee too easily

- giving away co-investments too easily

- not making a proper DD on the LP

- Closing an investment ticket