A Preliminary overview of the Luxembourg Corporate Tax challenge related thereto.

By the LPEA Young Tax Leaders

The article was published in the PE Insight/Out Magazine May 2021 edition. You can find the whole magazine here.

Supported by U.S. Treasury Secretary Yellen, the U.S. Treasury’s actions toward a global minimum tax escalated on 7 April 2021 with the publication of the “Made in America Tax Plan” (“MATAP”)

1. The MATAP report echoes the Global Anti-Base Erosion report for a minimum taxation (“GloBE”- also referred as “Pillar Two”) published by the Secretariat of the Organisation for Economic Co-operation and Development (“OECD”) on 14 October 2020 (“Pillar Two Report”)

2. The GloBE is designed to impact highly digitalized businesses but praises also to ensure that all internationally operating businesses pay a minimum level of tax. This article aims at providing a high- level overview of the GloBE (A) implementation, (B) mechanism and (C) key points of attention for the Luxembourg Private Equity industry.

A. The GloBE implementation: The international tax landscape is periodically shaped and reshaped through financials crises and changes in ways to run business models. In September 2013, in response to the financial crisis of 2008, the OECD and G20 countries adopted the now wellknown 15-point action plan to address base erosion and profit shifting (“BEPS”) thereafter consolidated into reports in November 2015.

In the context of monitoring and completing the implementation of the BEPS minimum standards, the tax challenges arising from the digitalization of the economy have been set as a top priority. Further to an initial interim report issued in March 2018, members of the OECD/G20 initiated Inclusive Framework3 agreed to examine the proposals regarding the digitalization of the economy in two pillars in January 2019. Pillar one (“Pillar One”) is focusing on nexus and profit allocation while Pillar Two (or GloBE) is focusing on a global minimum tax. Following a public consultation run end of 2019, the Pillar Two Report has been approved on October 2020.

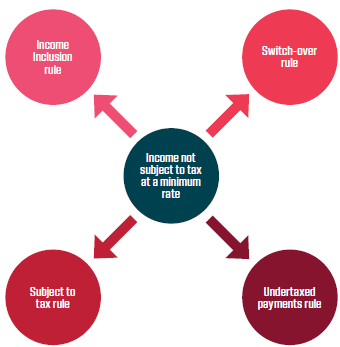

B. The GloBE mechanism: To get synergies with the Country-by-Country reporting rules, the GloBE should apply to MNE groups – and their constitutive entities – that have annual consolidated revenue of EUR 750 million or more in the immediately preceding fiscal year in domestic currency. The definition of a MNE group should rely on the requirement to prepare consolidated accounts. In order to allow the implementation by way of modifications to existing tax treaties and domestic legislation, the GloBE proposal relies on the following four components.

First, the income inclusion rule would tax income of a controlled foreign corporation or foreign branch if that income were subject to tax at an effective rate that is below a certain minimum rate.

Second, the switch-over rule that would permit a residence jurisdiction to switch from an exemption to a credit method where the profits attributable to a permanent establishment or derived from immovable property are subject to an effective tax rate below a certain minimum rate.

Third, the undertaxed payments rule relates to outgoing payments. It would operate by way of denying a deduction or introducing a withholding tax for payments to “related parties” that are not subject to tax at or above a certain minimum rate.

Fourth, the undertaxed payment rule would be complemented with a subject to tax rule that would subject a payment to withholding and adjusting tax treaty benefits on certain items of income where the payment is not subject to tax at a certain minimum rate.

The GloBE effective tax rate of a MNE group should be computed by dividing the amount of covered taxes by the amount of net income as determined under the GloBE rules (which include notably adjustments on intra-group flows, etc). At the time of implementation of the GloBE, it should be confirmed whether the minimum rate would be set by each country individually or through a global consensus. It is worth noting that the Pillar Two

Report includes a list of entities that are excluded from the GloBE rules. Such list includes investment and pension funds, governmental entities such as sovereign wealth funds and international and non-profit bodies, which typically benefit from an exclusion or exemption from tax under applicable domestic tax law4.

C. The GloBE key points of attention for the (Luxembourg) Private Equity industry: In order to qualify for the GloBe exclusion, an investment fund has to satisfy certain criteria (e.g. designed to pool assets, invests in accordance with a defined investment policy, fund or management of the fund should be subject to regulatory oversight, etc). The definition of investment funds also includes any entity that is almost exclusively or wholly-owned by a qualifying investment funds (or other excluded entity) and that does not carry on a trade or business but is established and operated to hold assets or invest funds for the benefit of the investment funds (or other excluded entities). It is then expected that holding companies of a Luxembourg qualifying investment fund could also be out of the scope of the GloBE. In that context, a careful monitoring of how the carve-out conditions will be implemented in practice should be done.

Many investors in investment funds are tax-exempt or otherwise benefit from low tax rates (e.g. pension funds). In this context, the application of the definition of “related parties” might trigger withholding tax (e.g. on dividends) or limitation of expenditures deductibility (e.g. interest expenses) paid to tax-exempt investors considered as “related parties”. It will therefore be key when implementing the GloBE rules to ensure that payments to such tax-exempt investors are excluded from the scope of the undertaxed payments rule and subject to tax rule. In the same vein as the law of 23 December 2019 implementing the Anti-Tax Avoidance Directive 2017/952 (i.e. ATAD 2), it could be envisaged to treat investors in investments funds as being de facto non “related parties”. Similar considerations hold true for investors that are in principle taxable but benefit from favorable tax rates on investment returns. The GloBE treatment of tax transparent entities should also be monitored.

Luxembourg funds could indeed be structured through tax transparent partnerships. In such case, it should be clarified how non qualifying tax transparent investments funds will be treated from a GloBE perspective since limited partners could in that case not be considered to be in the same MNE group as the portfolio companies. Alternative investments remain a high-risk business. Hence, for multi-invested funds, it will be important to allow profits from one investment to be offset against tax losses from other investments. Finally, with view to the relatively high Luxembourg’s statutory corporate income tax rate, the set-up of a minimum tax over a percentage of the domestic corporate income tax rate should limit the impact of the GloBE in Luxembourg.

Conclusion

Considering the envisioned pressure on public economies due to the economic crisis and the recent convergence of the US with the MATAP report, the rules on minimum taxation as per Pillar Two are likely to be introduced.

On 9 April 2021, the Finance minister Pierre Gramegna – as other EU states representatives – supported the MATAP initiative for a global minimum corporate tax to be implemented within the OECD framework.

By its nature and modus operandi, the Private Equity fund industry, as well as the Alternative Investment fund industry in a wider view, is a key actor when it comes to financing businesses on a worldwide scale. Over the last decades,

Luxembourg has successfully built a stable social, economic, legal and tax framework enabling international investors and asset managers to invest in and operate via Luxembourg investment fund platform on a reliable basis. In this context, it will thus be key to monitor that the implementation of the Pillar Two does not hamper the development of the Private Equity / Alternative Investment fund industry while ensuring fair standards to fight against tax evasion.