Securitisation – a Solution of Choice?

By Aurélien Hollard, Partner, CMS, José Juan Ocaña, Senior Associate at CMS, Julien Robert, Knowledge Lawyer at CMS, Adrien Rollé, CEO of OPPORTUNITY, Hugo Vautier,

By Aurélien Hollard, Partner, CMS, José Juan Ocaña, Senior Associate at CMS, Julien Robert, Knowledge Lawyer at CMS, Adrien Rollé, CEO of OPPORTUNITY, Hugo Vautier,

– Private equity and venture capital-backed companies add 341,910 net new jobs in 2021 – PE/VC-backed businesses employ 4.5% of Europe’s workforce Invest Europe, the

By Stéphane Ries, Board Member of LPEA, Managing Director, Financial Intermediaries, Quintet Private Bank Luxembourg as featured in Insight Out Magazine #25 At first glance, private

By Joaquín Alexandre Ruiz Tarré, Head of Secondaries at the European Investment Fund as featured in Insight Out Magazine #25 Now that we are

Report written by Titanbay Healthcare is one of the largest and fastest-growing global industries, and it has the power to transform living standards. Private equity

By Christian Harz, CFA, Director at Golding Capital Partners and Lukas Eckhardt, Director at Golding Capital Partners as featured in Insight Out Magazine #25 Alternative

The 25th edition of Insight/Out is out and features the story of an unequivocal figure of VC and Fintech in Luxembourg, Pascal Bouvier, Managing Partner

Accelex, a SaaS platform specializing in alternative investment data acquisition, reporting and analytics, has announced today the introduction of the private market’s first automated document

At a conference organized by Creobis on the 9th of March, experts and regulators reviewed the implementation of the Luxembourg AML/CFT regulation in the investment

At a webinar co-organised by the Luxembourg Private Equity & Venture Capital Association and the Luxembourg Valuation Professionals Association on 28 February, experts from the

Article by Tülin Tokatli, CFA Founder, Pitch Me First Raising funds from institutions for venture capital and private equity can be a long and arduous

Loyens & Loeff Luxembourg has implemented an ambitious and cutting-edge training program called the Private Equity Academy. The project has been developed internally with the

Article by Joseph Marks, Senior Managing Director – Head of Secondaries, Capital Dynamics, Mauro Pfister, Managing Director – Secondaries, Capital Dynamics, And Yvan Chene, Managing

Interview of Alex Bozoglou, Head of Investments, Titanbay as featured in Insight Out Magazine #24 If investors can take away one key lesson from the

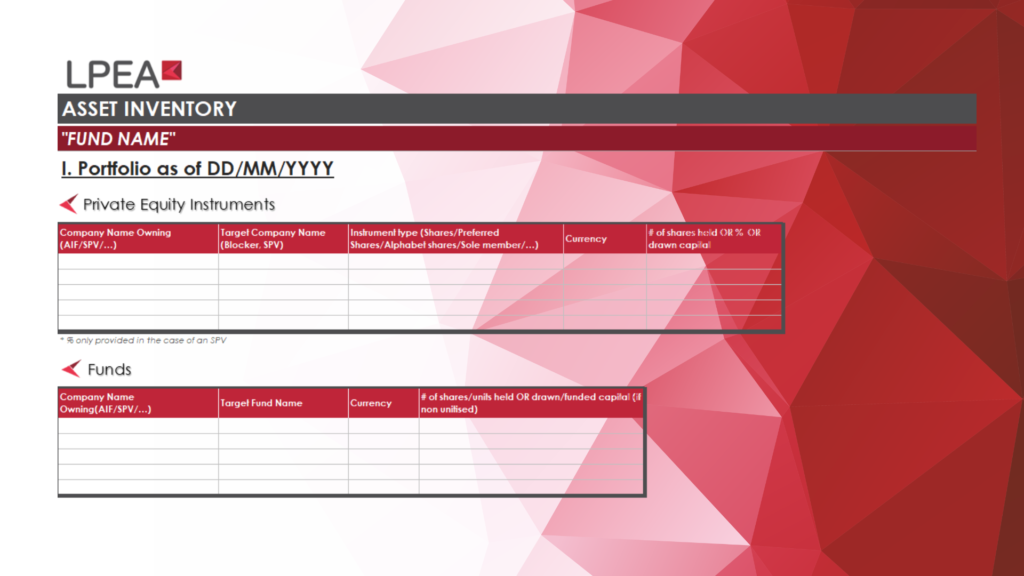

The LPEA Depositary committee has prepared a standard Asset Inventory form in order to standardise and streamline the overall process of the annual depositaries confirmations.

The LPEA obtained the ESR Entreprise Responsable label from INDR. This certification represents a commitment of the association in various areas such as sustainability strategy,

By Rym DELCROIX, Director at CONNECTreg Appointing an independent non-executive director (INED) on the Board is certainly not a box ticking to play the governance

STIBBE ending 2022 with winning Mergermarket Benelux Legal Adviser of the Year award – Recognising the best in the M&A community! Mergermarket, the leading provider

This survey result gauges current market sentiment and outlook for 2023 of LPEA full members, ie GPs and LPs. The survey was sent specifically to

Insight/Out #24 is out! The cover features a PE success story 100% made in Luxembourg focusing on ORAXYS and BGL BNP Paribas’s co-investment in the

The LPEA team would like to thank Mireille Reisen and Simon Emeri from the CSSF for presenting their publication AIFM Reporting dashboard – December 2021

We are pleased to invite you to take part in a study conducted by Mr Robert Stoll, a third-year doctoral student, as part of his thesis

The LPEA, together with Silicon Luxembourg have launched the Luxembourg Venture Capital Guide. The Venture Capital sector is a key player for the financing of

Sign up for our newsletter to stay updated on the latest news and insights.

© Copyright 2021 LPEA All Rights Reserved